Libya’s oil and gas minister has accused some international oil companies operating in the OPEC member of taking advantage of lax security in the country’s restive oil regions caught in fighting bouts since 2011, slacking off in implementing their development plans and seeking better contractual terms.

“Most of the IOCs have committed to specific projects and up till now they have unfortunately not acted as they should act,” Mohamed Oun told S&P Global Commodity Insights in a Nov. 21 interview.

“Since 2008, all companies submitted programs to develop whatever they have discovered and execute the remaining exploration and seismic surveys. Because of the circumstances in the country since 2011, there is a lot of slack from IOCs in executing their commitments in the exploration and production sharing agreements.”

Following the lifting of US sanctions in 2004, Libya managed to attract mainly US oil companies to take part in its first licensing round launched in 2005, where 15 blocks in the country were awarded to IOCs.

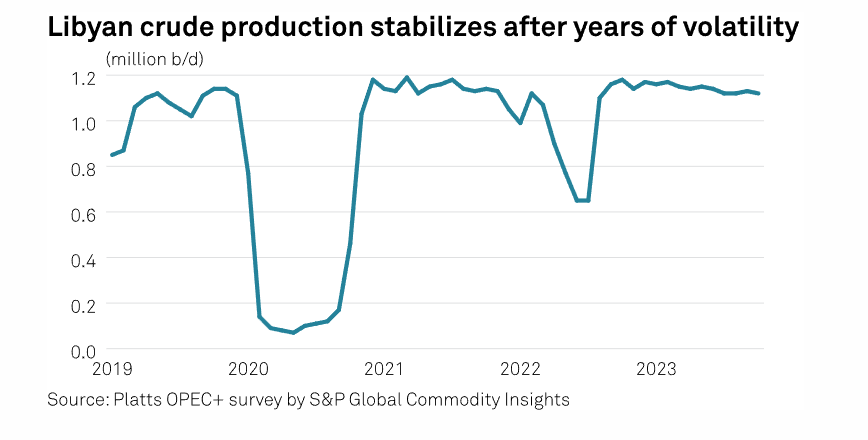

But since the 2011 downfall of Muammar Gaddafi, the country has been engulfed in several bouts of fighting between various militias that have led to several oil blockades. The political mayhem that ensued hit its vital oil sector, which has never been able to recover and return to producing 1.6 million b/d. An oil blockade in the summer of 2022 pushed production to a two-year low of 650,000 b/d, according to the Platts survey by S&P Global. Production has since recovered to reach the 1.2 million b/d production capacity level because Libya is exempt from OPEC+ quotas.

Relinquish concessions

IOCs that haven’t executed their commitments need to relinquish their concessions and hand them back to NOC, which should award them to other companies, Oun said.

IOCs are also exploiting Libya’s need for petrodollar revenue and foreign expertise to develop its resources to exact better contractual terms from NOC, he added.

TotalEnergies and ConocoPhillips are renegotiating with NOC to double their paid cost to 13% from 6.5% in the current agreement, without involving the oil ministry in these talks, Oun said. Both companies declined to comment on these talks when contacted by S&P Global. NOC didn’t reply to requests for comment.

“I am totally surprised and astonished by the request of TotalEnergies and ConocoPhillips to double this percentage because it (the current 6.5% percentage) was a temporary measure,” said Oun, who has been involved in Libya’s oil sector since 1974, with stints at Occidental and NOC until being appointed oil minister in 2021.

“With fields discovered years ago and the potential of Waha, they can double production.”

Waha Oil Co., majority owned by NOC, produces more than 300,000 b/d.

Opening doors

Requests by TotalEnergies and ConocoPhillips to renegotiate their contractual terms come after Eni managed to increase its percentage in a deal with NOC signed in January to develop offshore Structures A&E, he said. The Eni-NOC deal violates a number of laws because it raises the Italian company’s paid percentage to 37% from 30% previously, he added. The 25-year agreement is the largest such energy deal for Libya in more than a quarter of a century, with the offshore blocks having confirmed gas reserves of about 6 Tcf.

Eni’s renegotiations with NOC have “opened the doors” for other IOCs to request similar changes, Oun said.

Oun also is critical of NOC’s talks with Eni, TotalEnergies and UAE-based Abu Dhabi National Oil Co. to develop Hamada gas field after getting pre-approval to initiate negotiations from the High Council for Energy Affairs. TotalEnergies and ADNOC declined to comment, while Eni didn’t reply to S&P Global requests seeking comment.

Oun said he submitted in 2022 a proposal to the cabinet to fast-track the development of Hamada and Arous Al Bahr fields, but then NOC went to the council and secured pre-approval for its talks.

Licensing round

Despite issues with IOCs, Oun said Libya is moving ahead with plans to boost its oil production capacity to 2 million b/d in three-to-five years, with the help of existing IOCs and the development of existing fields and discoveries.

Libya sits on Africa’s largest oil reserves estimated at 48 billion barrels, but around 40% of its land, both onshore and offshore, has not been surveyed, Oun said.

That’s why NOC is expected to launch a licensing round in 2024 for several blocks to boost exploration activities, with most new oil resources located onshore and gas sources offshore, he added.

Libya is also keen to boost its gas production, which hovers around 2.6 bcf/d, by tapping its 56 TCF reserves to add an extra 2 bcf/d.

Libya, through the Mellitah Oil & Gas joint venture between Eni and NOC, exports between 300-400 MMcf/d to Italy via the Greenstream pipeline.

But rising domestic gas demand, especially for power generation, is consuming most of the production and limiting any increase in exports, Oun said.

Libya used to supply more than 400 MMcf/d to Italy in previous years, but had to reduce exports to meet its local needs, Oun said. Eni’s development of Structures A&E may add 700 MMcf/d, but the country’s domestic needs are three or four times higher than this figure, he added.

Source : S&P Global